With 30 June 2020 fast approaching there are a number of new tax concessions and year end strategies that can be considered to put you in the best tax position for 2020.

If you have any questions on any of the below please contact your Letizia Palmer accountant.

Year End Tax Planning – Businesses

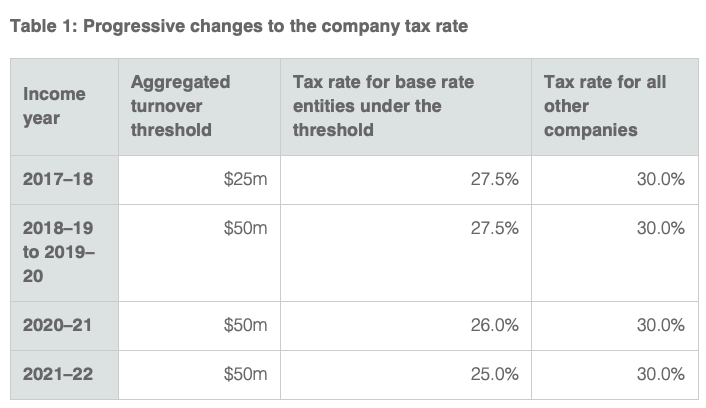

Changes to Company Income Tax Rates

The lower company tax rate applies to base rate entities with an aggregated turnover less than $50 million from the 2018–19 income year. The rate will then reduce to 25% by the 2021–22 income year.

Concessions Available for Small Business Entities

Businesses that are small business entities (group-wide turnover below $10 million) may qualify for the following tax concessions in the 2020 income tax year:

- Immediate deduction for depreciating assets costing less than $30,000 or $150,000;

- Simplified depreciation rules for all other depreciating assets;

- Small business restructure rollover;

- Immediate deduction for start-up costs;

- Immediate deduction for certain prepaid expenses;

- Simplified PAYG tax instalment rules;

- Cash basis accounting for GST, ATO-calculated GST instalments; and

- FBT exemption for car parking, providing multiple portable electronic devices (eg laptops, mobile phones)

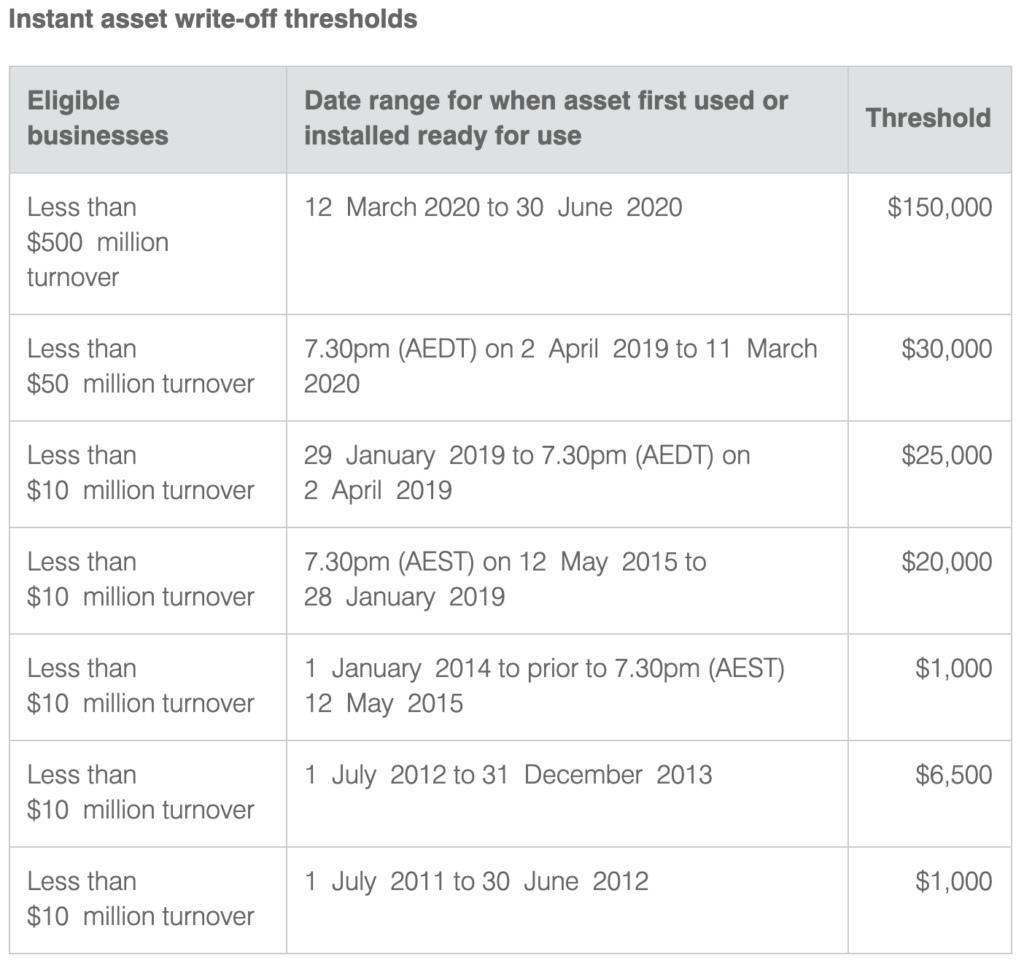

Instant Asset Write-Off

The government has increased the immediate asset write-off for eligible businesses. The following thresholds apply for the 2020 financial year:

Under instant asset write-off eligible businesses can:

- immediately write off the cost of each asset that cost less than the threshold

- claim a tax deduction for the business portion of the purchase cost in the year the asset is first used or installed ready for use.

Instant asset write-off can be used for both new and second-hand assets. Some exclusions and limits apply.

The $150,000 threshold runs through to 31 December 2020.

Accelerated Depreciation

Applies to all newly acquired depreciating assets which are not eligible for the instant asset write-off. This concession will provide an immediate tax deduction of 50 per cent of the cost of the eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost.

This measure will apply to eligible new (not second hand) depreciating assets acquired from 12 March 2020 and first used or installed by 30 June 2021. There is no limit to the cost of a depreciating asset that can qualify for this concession, which means it will be particularly relevant for those depreciating assets which are not eligible for the instant asset write-off.

Eligible Assets:

To be eligible to apply the accelerated rate of deduction, the depreciating asset must:

- be new and not previously held by another entity (other than as trading stock)

- be first held on or after 12 March 2020

- first used or first installed ready for use for a taxable purpose on or after 12 March 2020 until 30 June 2021

- not be an asset to which an entity has applied the instant asset write-off rules or depreciation deductions.

There is no limit on the number of eligible assets that you can apply accelerated depreciation to in an income year.

Eligible assets do not include:

- second-hand depreciating assets

- some specific Division 40 assets subject to low value and software development pools

- certain primary production assets

- buildings and other capital works for which you can deduct amounts under Division 43

- other specific capital asset and expense deductions

- assets you were committed to acquiring before 12 March 2020.

There is no limit on the cost of an eligible asset to which you can apply accelerated depreciation to, unless it is a passenger vehicle (except a motorcycle or similar vehicle) designed to carry a load of less than one tonne and fewer than nine passengers.

If you purchase such a passenger vehicle costing more than the car limit at the time, you must reduce the cost of the car to the car limit before calculating your depreciation. You cannot claim the excess cost of the car above the car limit under any other depreciation rules.

If accelerated depreciation is to be applied to the purchase of an asset used for Research & Development (R&D) purposes, you can only claim the R&D tax offset for the proportion of the decline in value that is for R&D use. In working out the amount in relation to R&D use, you must subtract any non-R&D use (including the taxable purpose portion and private use portion).

Eligible Business:

Under the measures, different rules apply depending on whether an entity is using the simplified rules for capital allowances for small businesses.

Small business entity:

If you are a small business with an aggregated turnover of less than $10 million, and you use the simplified depreciation rules, those assets over the instant asset threshold which are eligible for the accelerated depreciation are added to the general small business pool. You can deduct an amount equal to 57.5% (rather than 15%) of the business portion of a new depreciating asset in the year you add it to the pool. In later years the asset will be depreciated under the general small business pool rules.

Other business entities:

If you are an entity with aggregated turnover less than $500 million in the income year and do not use the simplified depreciation rules, you may be eligible to deduct an amount if the asset is a qualifying asset.

The amount your entity can deduct in the income year the asset is first used or installed ready for use is:

- 50% of the cost (or adjustable value where applicable) of the depreciating asset

- plus the amount of the usual depreciation deduction that would otherwise apply but calculated as if the cost or adjustable value of the asset were reduced by 50%.

ATO Administrative Relief

Options available to assist businesses impacted by COVID-19 include:

- Deferring by up to six months the payment date of amounts due through the business activity statement (including PAYG instalments), income tax assessments, fringe benefits tax assessments and excise

- Allow businesses on a quarterly reporting cycle to opt into monthly GST reporting in order to get quicker access to GST refunds they may be entitled to

- Allowing businesses to vary Pay As You Go (PAYG) instalment amounts to zero for the March 2020 quarter. Businesses that vary their PAYG instalment to zero can also claim a refund for any instalments made for the September 2019 and December 2019 quarters

- Remitting any interest and penalties, incurred on or after 23 January 2020, that have been applied to tax liabilities

- Working with affected businesses to help them pay their existing and ongoing tax liabilities by allowing them to enter into low interest payment plans.

The above measures are not automatic, and affected businesses, or their tax agent, must contact the ATO and request the benefit of one or more measures.

Review Your Bad Debts and Obsolete Plant and Machinery

Before 30 June, outstanding debtors should be reviewed to determine the likelihood of not receiving payment and whether attempts to recover the debts will be successful.

If the debt is irrecoverable and if income is reported on an accruals basis, the debt can be regarded as a bad debt for which a tax deduction may be claimed. This process must occur before 30 June.

This same methodology applies to scrapping obsolete plant and machinery. In such a case you should review your asset register, identify, scrap (i.e. physically dispose of) and claim a deduction for the written down value of such assets.

Superannuation Deductions

Pay superannuation contributions before 30 June

Both employees and self-employed individuals can claim a tax deduction annually to a maximum of $25,000 for personal superannuation contributions, provided the superannuation fund has physically received the contribution by 30 June 2020 and the individual has provided their superannuation fund with a notice of intention to claim.

Payments to a superannuation fund should be made sufficiently in advance of 30 June to ensure there is time for the payment to be processed and credited to the fund’s bank account by 30 June. If it is not credited to the fund’s bank account by 30 June, the deduction will be deferred to the next income year.

For business owners, in order to claim a tax deduction for your employee’s superannuation liability you must pay the superannuation prior to 30 June 2020.

Catch-up contributions to superannuation

If your superannuation balance is below $500,000 as at the previous 30 June, you can contribute more to superannuation than the annual $25,0000 deductible contribution cap where your contributions in prior years were below $25,000. Employer contributions are counted for this purpose, and there are contribution and timing limits.

Taxable Payments Annual Reporting

Businesses in the building and construction, cleaning, courier, road freight, IT, and security, investigation or surveillance industries must lodge a taxable payments annual report (TPAR) by 28 August 2020. The report includes the total payments made to contractors.

Year End Tax Planning – Individuals

Work Related Expenses

To claim a work-related deduction:

- you must have spent the money yourself and weren’t reimbursed

- it must directly relate to earning your income

- you must have a record to prove it

You may be able to claim a deduction for expenses that directly relate to your work, including:

- Vehicle and travel expenses

- Clothing, laundry and dry-cleaning expenses

- Home office expenses

- Self-education expenses

- Tools, equipment and other assets

- Other work-related deductions

Working From Home – Running Expenses

In response to COVID-19, many people have been working from home for an extended period. From 1 March to 30 June 2020 only (might be extended), a temporary, simplified method is allowed for calculating your allowable deduction arising from working from home.

You can claim a deduction of 80 cents for each hour you work from home due to COVID-19, as a representation of all additional deductible running expenses as a result of working from home. However, you must be working from home to fulfil your employment duties and not just carrying out minimal tasks such as occasionally checking emails or taking calls.

You do not have to have a separate or dedicated area of your home set aside for working, such as a private study.

There are two other alternative methods for calculating your deductible running expenses:

- 52 cents per hour to cover certain running costs, plus calculated work-related portion for others.

- Actual work-related portion, calculated for all running costs.

If you need help with your business or personal taxes for the 2019-2020 EOFY, get in touch with our team.